Youth Accounts

Start building good financial habits today

It’s never too early to begin developing sound money habits. Help guide your young children and teens on their financial journey with an RBFCU Youth Savings and Youth Checking account.

Youth Account benefits and features:

No Annual Fees

Easily transfer money from your account to your child's

Free financial education resources

Membership eligibility required. Accounts for minors require additional ownership by a parent, guardian or other adult.

Savings account

Give children and teens the opportunity to learn how a penny saved is a penny earned.

Checking account with a Freedom Debit Card

Debit card for teens and kids with $0 liability on unauthorized purchases.

Not a member?

If your child is not an RBFCU member yet, you can open an account for them (and yourself!) online. You can also join by calling us at 210-945-3300 or by visiting any RBFCU branch.

Already a member?

If you and your child are already RBFCU members, you can open an additional youth account for them by calling us at 210-945-3300 or by visiting any RBFCU branch.

Members are required to open a primary savings account with a minimum deposit of $1, which must remain in the account at all times. A $1 minimum balance is required to earn the stated Annual Percentage Yield (APY). A checking account can be opened with a zero balance.

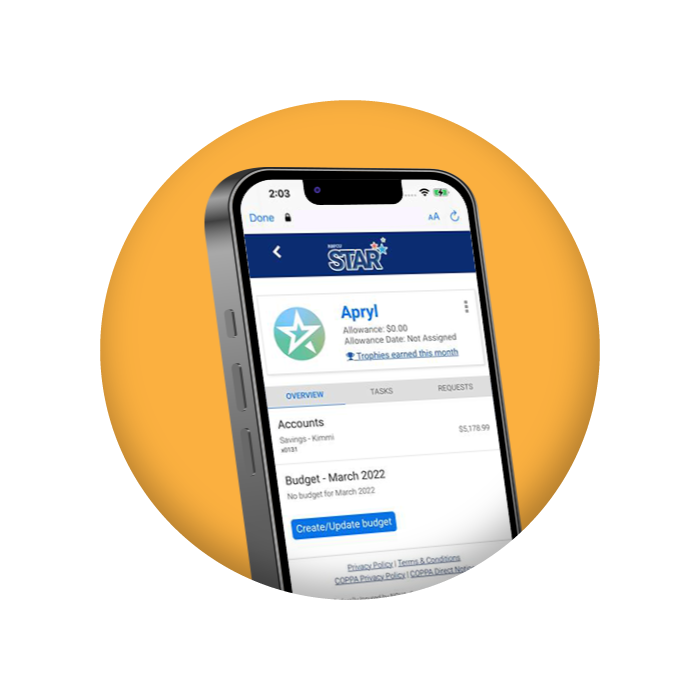

RBFCU STAR Program*

Help young members build strong financial skills

It’s never too early to help young children or teens build strong savings habits.

RBFCU STAR encourages kids, teens and young adults to learn about finances first-hand through an interactive tool accessible from Online Banking or the RBFCU Mobile app — which also gives you the ability to reward your young saver for hard work and completing tasks.

Your savers can also ask you for small loans, request controlled amounts of spending money and earn rewards for making sound financial decisions!

Learn more, earn more, save more

Learn the basics of budgeting, how to start saving, good vs. bad spending habits and more with free financial education resources.

Related Articles

Membership eligibility required. Accounts for minors require additional ownership by a parent, guardian or other adult.

No minimum age requirement.