Troubleshooting the RBFCU Mobile® App

If you’re having issues with the RBFCU Mobile app, we’re here to help. Here are solutions to common challenges members experience with signing in, biometric usage, usernames, passwords and more:

How to update | General questions | Device support & settings | Sign-in help | Help with biometric sign-in (Fingerprint, Touch ID®, Face ID®, etc.) | Sign-in Alerts | Multifactor Authentication (MFA) | Video & in-app tutorials | Help with features | Quick Balance help | Widget help | Help with Plaid | Additional help

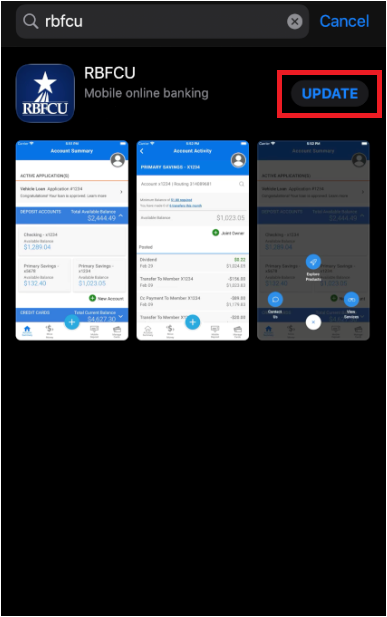

First step in troubleshooting: Update your app to the latest version

While you’ll only need to download the RBFCU Mobile app once, RBFCU will periodically release updated versions as we make improvements.

If you’re having issues using the app, please verify your device is using the latest version, and update if necessary.

To verify you have the latest version of the RBFCU Mobile app:

- Go to the RBFCU Mobile app listing on the Apple® App Store® or Google Play™ on your phone.

- If you see an “Update” button, your app needs to be updated to the latest version.

- Tap the button to update, then open the RBFCU Mobile app and see if your issue persists. If your issue isn’t resolved, read the FAQs below for more guidance.

Please note: The latest operating systems (OS) versions are required for security updates and will provide the best experience while using the RBFCU Mobile app. The minimum supported OS1 to use the RBFCU Mobile app are:

- iPhone® iOS 13 or later

- iPadOS® 13 or later

- Apple Watch®2 watchOS® 10 or later

- Android™ OS 5.1 or later

The best way to make sure you’re getting the RBFCU Mobile app’s latest features and security enhancements is to enable automatic app updates on your device. See “How do I get the RBFCU Mobile app to update automatically?” below for instructions.

1Some devices may not be supported due to hardware limitations.

2Currently Apple Watch can be used to check available account balances only.

Sign-in Alerts make it easy to prevent unauthorized access to your Online Banking account

This security feature will automatically notify you via text message, email or push notification as soon as someone attempts to use an unrecognized device to sign in to your account at rbfcu.org or through the RBFCU Mobile app, so you can take immediate action to prevent unauthorized access.

Here’s how it works:

Add Multifactor Authentication (MFA) for an extra layer of security

RBFCU offers MFA as an extra layer of security when you sign in to the RBFCU Mobile app.

If you choose to enable MFA, RBFCU will use it to verify high-risk sign-in attempts for your account. For example, if you get a new phone, RBFCU will prompt you to provide your MFA code the first time you try to sign in to your Online Banking account, just to make sure it’s really you. You’ll also have the option to use MFA every time you sign in, which greatly strengthens your account’s security.

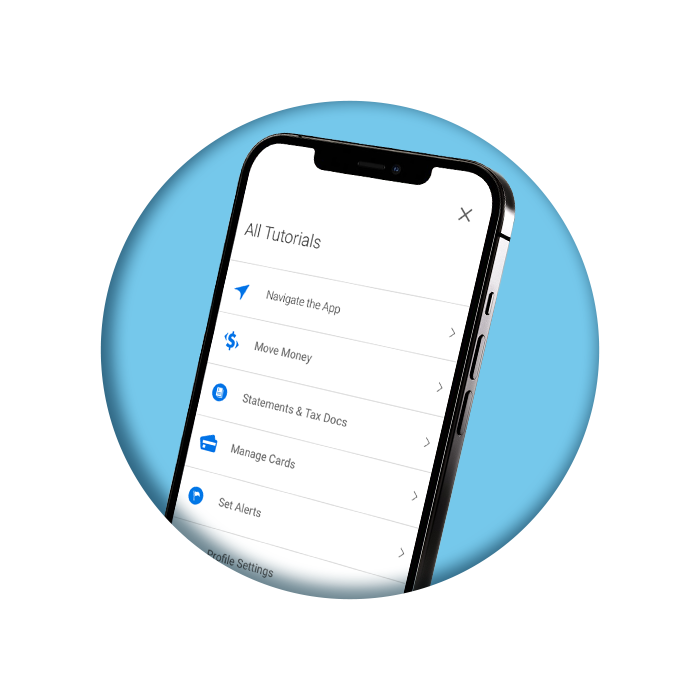

Tutorials to help along the way

Need help using Move Money, Manage Cards or some of the RBFCU Mobile app’s other popular features? Just look for the ?, aka the help icon! If you see the ? in the top left corner of your screen, tap it to get a tutorial on how to use that feature. Swipe through the step-by-step instructions at your own pace. You can close or revisit the tutorial at any time.

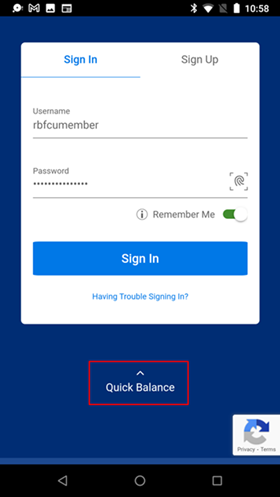

Quick Balance: What is it, and how does it work?

Quick Balance is a feature that allows you to see limited information about your account — like your account’s nickname and current balance — at a glance on the RBFCU Mobile app sign-in page, without signing in to the app.

However, you must enable push notifications for the RBFCU Mobile app and sign in to the app at least once to activate Quick Balance. Look for the FAQ titled “How do I enable push notifications for the RBFCU Mobile app?” for help enabling push notifications.

Please note: Anyone who uses your mobile device will be able to see your account balances when Quick Balance is enabled. Quick Balance must be enabled to use the RBFCU Mobile app on your Apple Watch.

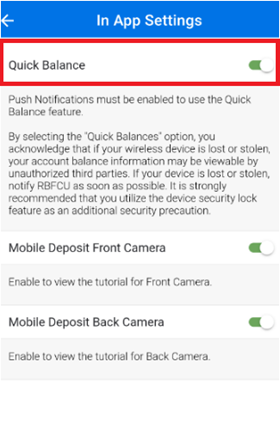

How to enable Quick Balance in the RBFCU Mobile app

1. Open the RBFCU Mobile app

Open the RBFCU Mobile app and, before you sign in, look for “Quick Balance” at the bottom of the sign-in screen.

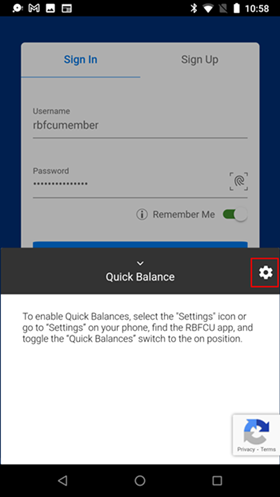

2. Select Quick Balance settings

Tap “Quick Balance” to bring up the feature. Tap the settings (gear) icon on the right to open the Settings app on your phone.

3. Turn on 'Quick Balance' in Settings

In the RBFCU Mobile app settings, turn the toggle switch next to “Quick Balance” to the “on” position.

Widget: What is it, and how does it work?

The RBFCU Mobile app widget is a tile on your device’s home screen that allows you to see a snapshot of your account information — like your account's nickname and current balance — without opening the app.

Please note: To use the widget, you must enable Quick Balance, which means anyone who uses your mobile device will be able to see your account balances.

How to enable the RBFCU Mobile app widget

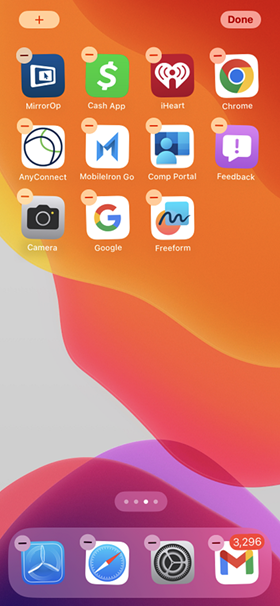

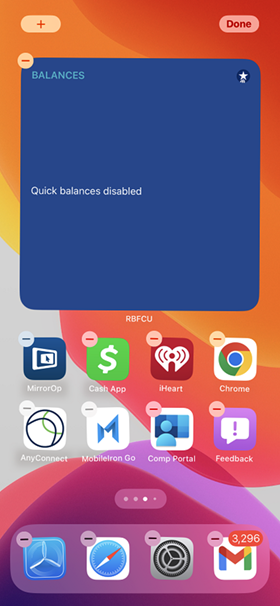

1. Edit the home screen

Hold your finger down on your device’s home screen until the edit screen appears. On Apple devices, you can also tap the “Edit” button at the bottom of your home screen.

Apple devices

Android devices

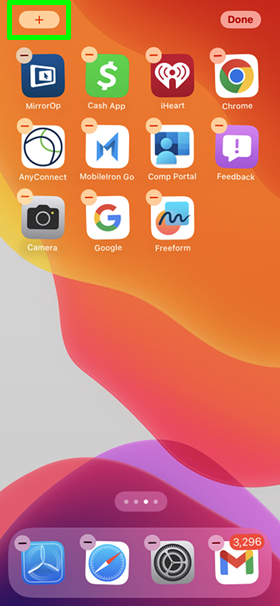

2. Tap to add a widget

Apple devices

On Apple devices, tap the + in the top left corner.

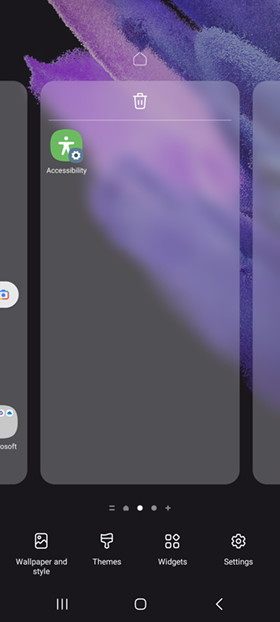

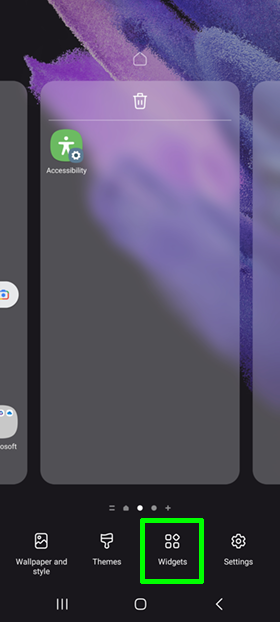

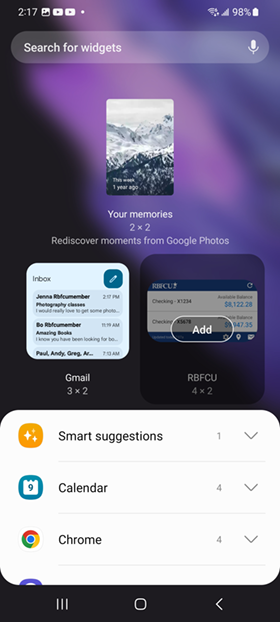

Android devices

On Android devices, tap “Widgets.”

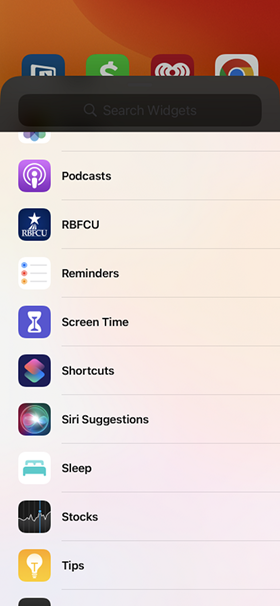

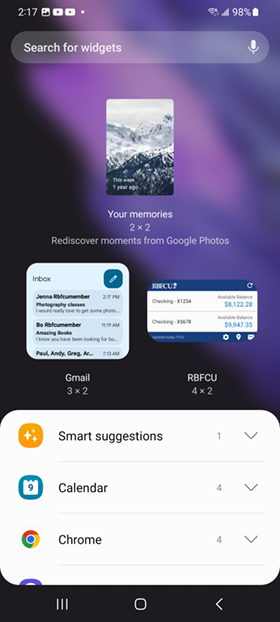

3. Find the RBFCU Mobile app widget

Find and select the RBFCU Mobile app widget. On Android devices, hold the widget until you’re allowed to place it.

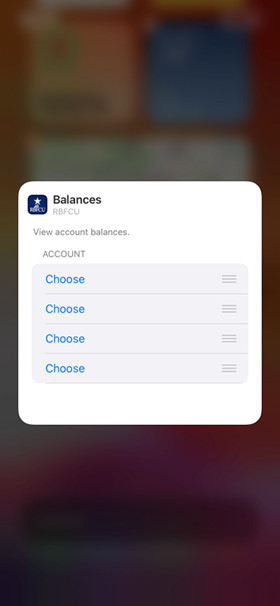

Apple devices

Android devices

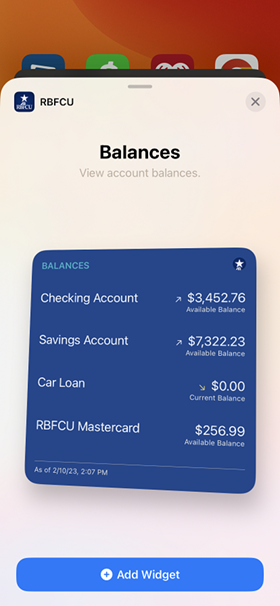

4. Place and resize

Place the RBFCU Mobile app widget on your home screen and adjust to your desired size.

Apple devices

Apple users can also choose the order in which their accounts will appear.

Android devices

Additional help

Still having issues? Contact RBFCU and a representative will be able to provide assistance. Visit rbfcu.org/chat and select the chat icon in the bottom right corner to chat with a Member Service Representative.

Chat representatives are available 7 a.m. to 7 p.m. Monday through Friday, and 9 a.m. to 4 p.m. on Saturday.

You can also email or call to speak with a representative:

- mobileapp@rbfcu.org

- San Antonio/Corpus Christi/Dallas-Fort Worth: 210-945-3300

- Austin: 512-833-3300

Representatives are available by phone from 8 a.m. to 6 p.m. Monday through Friday, and from 8:30 a.m. to 4 p.m. Saturday.

RBFCU does not charge a fee for the RBFCU Mobile app, but you may be charged for data by your mobile wireless provider.

Enrolling in Alerts is free, but you may be charged for text messages by your mobile wireless provider. Alerts are a supplemental service and are not a replacement for responsible account review and management. You are responsible for any fees or charges incurred on your account whether you receive your Alerts or not.

All trademarks and brand names belong to their respective owners. Use of these trademarks and brand names do not represent endorsement by or association with RBFCU.

RBFCU and RBFCU employees will never initiate a phone call, email or text message to anyone — members or non-members — asking for your sign-in information, including usernames, passwords, security questions and answers, multifactor authentication (MFA) codes, MFA recovery codes and one-time passcodes (OTP), or other personal information, like account, credit card, debit card or Social Security numbers. Also, RBFCU employees will never need to sign in to your Online Banking account on your behalf. If someone contacts you claiming to be an RBFCU employee and asks you to approve a sign-in request for them, do not respond.

If you receive a suspicious phone call, email or text message, hang up, do not respond to the message, do not click any links, and do not open any attachments. Forward any suspicious emails and text message screenshots to abuse@rbfcu.org, then delete the message. If you believe your account, username or password has been compromised, you should immediately contact RBFCU at 210-945-3300 for assistance. Additionally, members should monitor their accounts regularly and report any suspicious transactions.