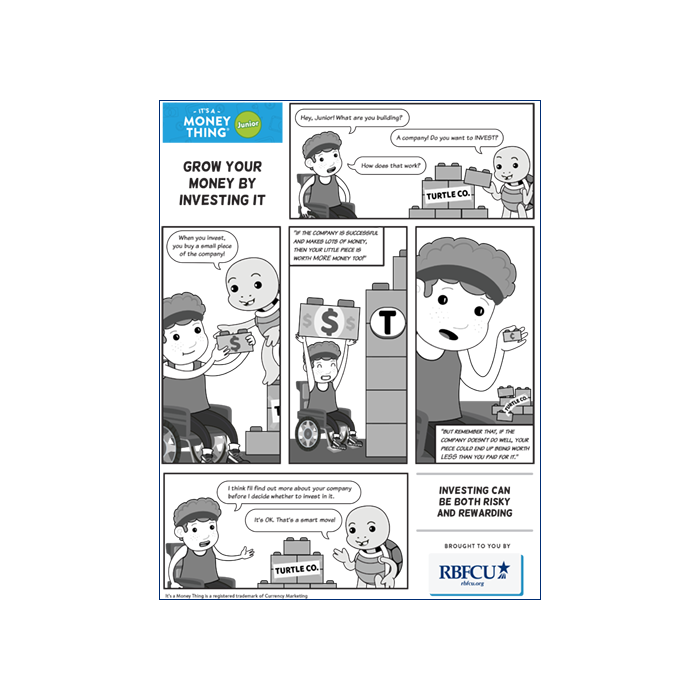

Growing Money: Investing Can Be Rewarding, but It's Also Risky

A savings account is a great place to store your money at first. It’s safe and it pays a little interest. But it won’t make you rich! Growing your money requires that you move some of it into investments with a potentially higher rate of return.

Many financial experts suggest that your money should be growing somewhere between 5% and 10% per year. You won’t get that from a savings account these days.

Just compare $100 in a savings account earning 1% interest per year with an investment earning 5% per year and another earning 10% per year.

(Article continues below video)

At 1% interest, your investment won’t increase much. After 20 years, you will have $122.02.

With a 5% return, you more than double your money to $265.33.

And with a 10% return, your money grows more than six times to $672.75!

However, investments aren’t insured like your savings account. You take the risk of losing everything if your investment becomes less valuable.