VehicleVantage Auto Loan

Get More For Less

Are you experiencing “sticker shock” while shopping for a vehicle? Are you lowering your standards to get the vehicle payment you can afford instead of the vehicle you want? If so, our VehicleVantage Auto Loan can offer a lower monthly payment with savings as high as 40%.

To apply for a VehicleVantage Auto Loan, contact us at 210-945-3300.

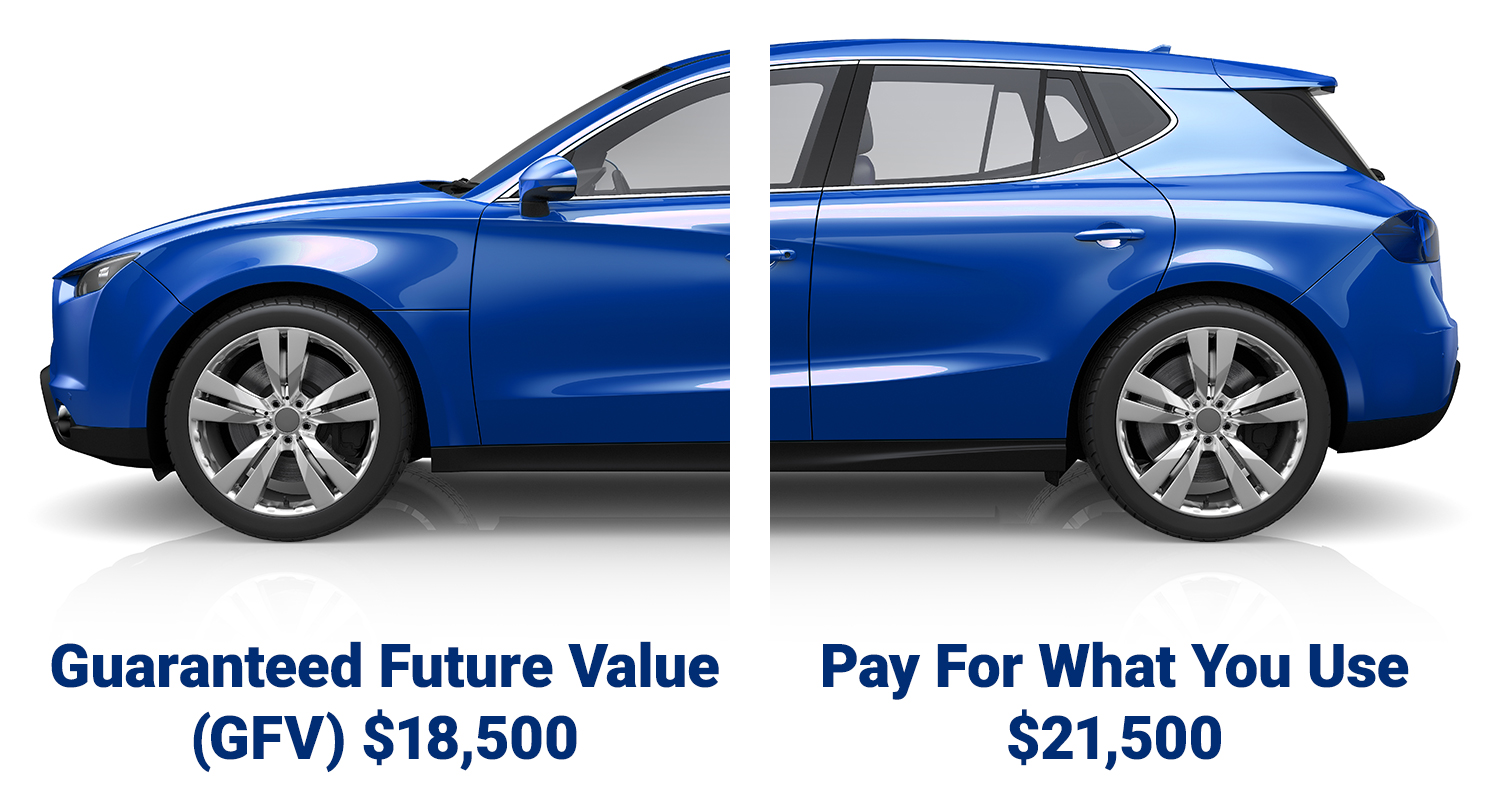

WHY PAY FOR THE WHOLE CAR? PAY FOR WHAT YOU USE.

$40,000 CAR

Payments are based on actual use of vehicle (depreciation) with the final payment being based on the projected resale value (Guaranteed Future Value) of the vehicle at loan maturity.

Why choose RBFCU VehicleVantage?

- New and pre-owned vehicles up to five years old qualify

- Flexible loan terms of up to 72 months at competitive rates

- Annual mileage options of 7,500, 10,000, 12,000, 15,000 and 18,000 available

- No security deposit, acquisition fees or early payoff penalty

- More options prior to loan maturity and at loan maturity with title in your name

New, Used, Refinance? We’ve got another option.

$0 due at signing

Get into your new car with just your signature and no money due at signing.

Flexible mileage options

Save money by choosing the mileage option that works best for your lifestyle; between 7,500 to 18,000 miles per year.

Titled to you

You can trade-in, sell or pay off your vehicle at any time because the vehicle is titled to you, giving you more freedom with your auto loan.

Option to 'Walk Away'*

You can surrender your vehicle and walk away when paying to the end of your loan term, if you’re ready for a different vehicle.

No negative equity

Break the negative equity cycle! With a Guaranteed Future Value when paying to the end of your loan term, you can end with a clean slate and start a new adventure.

No early termination fees

No early termination fees if you choose to trade, sell or pay off your vehicle at any time.

40% lower monthly payments? Here’s how it works:

Example: A vehicle loan amount of $30,000, a loan term of 36 months, and a Guaranteed Future Value (GFV) of $16,500

| Financing Option | Conventional Loan | RBFCU VehicleVantage |

|---|---|---|

| Loan Amount | $30,000 | $30,000 |

| Monthly Payments | $869 | $464.80 |

Loan Amount

Conventional Loan :

RBFCU VehicleVantage :

$30,000

$30,000

Monthly Payments

Conventional Loan :

RBFCU VehicleVantage :

$869

$464.80

Payments 1-35 are $464.80 with a 36th payment of $16,500 (GFV). You save $404.20 per month.

-

Which model-year vehicles are eligible for VehicleVantage?

Future year, current year and used vehicles up to five model-years old are eligible for VehicleVantage.

-

What vehicles are not eligible for VehicleVantage?

Vehicles not eligible for VehicleVantage include those considered “Grey Market,” “Lemon Law,” salvaged vehicles, vehicles older than five model-years, or select vehicle models. The loan calculator will not display vehicles that are not eligible for the program.

-

What is the Guaranteed Future Value (GFV)?

The Guaranteed Future Value is the projected end of the VehicleVantage loan term “resale” value of a vehicle. This value is guaranteed by Auto Financial Group (AFG).

-

Is the 'Walk Away' option available before the scheduled loan maturity?

No. The “Walk Away” option is only available when the VehicleVantage loan is paid to the end of the loan term.

-

What are the mileage options for a VehicleVantage Auto Loan?

The annual mileage options for a VehicleVantage Auto Loan are 7,500, 10,000, 12,000, 15,000, or 18,000, in addition to the current mileage on the odometer when financed. For example, if the borrower selects the annual mileage option of 15,000 and is in a four-year loan term, they may not accumulate more than 60,000 additional miles without incurring an excess mileage fee.

If the borrower exceeds the elected mileage allowance, they will be charged $0.10 for each mile in excess of 60,000 miles if they elect to surrender their vehicle to Auto Financial Group (AFG) via the “Walk-Away” option at loan maturity. If the borrower elects to trade, refinance, sell, or pay off the loan then over mileage fees are not applicable.

-

What are payments like with a VehicleVantage Auto Loan?

Unlike a conventional auto loan where your loan payments remain the same throughout, with a VehicleVantage Auto Loan, you'll make smaller monthly payments in exchange for one larger payment at the end of your term. This final payment is based on the Guaranteed Future Value of the vehicle, which is agreed upon up front.

-

What ownership options do I have with VehicleVantage?

VehicleVantage Auto Loans have the following ownership options:

- At any time: Pay off and keep the vehicle, trade it in to a dealership, sell it privately, or refinance and keep the vehicle.

- At the end of your loan: All of the above options are available, or you may surrender the vehicle via the “Walk-Away” option and turn it in, instead of paying the final Guaranteed Future Value payment.

-

What are the advantages of a VehicleVantage Auto Loan over a conventional auto loan?

You only pay for what you use, which results in a lower payment with a VehicleVantage Auto Loan since payments are based on actual use of the vehicle (depreciation) with the final payment being based on the projected resale value (Guaranteed Future Value) of the vehicle at loan maturity.

-

How can I apply for a VehicleVantage Auto Loan?

Please contact our Consumer Lending Center at 210-945-3300 to apply for a VehicleVantage Auto Loan.

-

What are the terms available for the VehicleVantage Auto Loan?

VehicleVantage offers flexible loan terms available up to 72 months at competitive rates.

-

Could I have more than one VehicleVantage Auto Loan at a time?

Yes. Credit permitting, a borrower can have more than one VehicleVantage Auto Loan.

-

Is a VehicleVantage Auto Loan only for a purchase of a new/used auto?

No. You can also refinance an existing auto loan with a VehicleVantage Auto Loan.

-

Could I use a Vehicle Buyer's Check (VBC) for a VehicleVantage Auto Loan?

No, you cannot use a Vehicle Buyer's Check for a VehicleVantage Auto Loan. There are limitations on vehicles that are eligible for VehicleVantage.

-

How do I know if a vehicle is eligible for the VehicleVantage Auto Loan?

You can contact our Consumer Lending Center at 210-945-3300 or use the calculator on the VehicleVantage page to check if the vehicle you are interested in is an option.

-

Is the VehicleVantage Auto Loan a lease?

No. You are not locked in with a VehicleVantage Auto Loan. You have options to trade, sell, refinance or pay off with no penalty at any time during the loan.

-

Can I add credit union products to the VehicleVantage Auto Loan?

Yes. You can add Credit Insurance, Mechanical Repair Coverage, and/or Guaranteed Asset Protection (GAP) Plus to a VehicleVantage Auto Loan.

-

Are there any additional fees for a VehicleVantage Auto Loan?

Fees for disposition ($195), excess mileage ($0.10 per mile) and/or damage to the vehicle may apply with a VehicleVantage Auto Loan, but only if you decide to return the vehicle at the end of term to exercise the “Walk Away” option.

If you choose to sell, trade, refinance or pay off your VehicleVantage loan, then there are no fees for disposition, excess mileage and/or damage.

-

Could I finalize a VehicleVantage Auto Loan at the dealership when purchasing my vehicle?

No. Currently a VehicleVantage Auto Loan is only available when finalizing directly with RBFCU.

Auto loans subject to credit review and approval. Rates and terms subject to change without notice. Some restrictions may apply.

Monthly payments vary based on interest rate borrower is approved for and amount borrowed. FOR EXAMPLE: A 72-month new VehicleVantage loan with a 7.50% fixed APR would have monthly payments of $17.29 per one thousand dollars borrowed. A 72-month new VehicleVantage loan with a 18.00% fixed APR would have monthly payments of $25.14 per one thousand dollars borrowed.

*Fees for disposition, excess mileage and/or damage may apply only if you decide to return the vehicle at the end of term to exercise the “Walk Away” option instead of choosing to sell, trade, refinance or pay off.

For complete details, contact the Consumer Lending Center.